Article content material

(Bloomberg) — Pakistan clinched an preliminary approval from the Worldwide Financial Fund for a $3 billion mortgage program, reducing the chance of a sovereign default.

Article content material

The staff-level settlement is topic to approval by the IMF Govt Board, with its consideration anticipated by mid-July, the Washington-based lender stated in a press release on its web site. Pakistan is without doubt one of the greatest prospects of the IMF with nearly two dozen bailouts because the Nineteen Fifties.

Article content material

The funds will assist the authorities’ instant efforts to stabilize the economic system from current exterior shocks, protect macroeconomic stability and supply a framework for financing from multilateral and bilateral companions, the lender stated.

Pakistan agreed to boost taxes and minimize spending in a dramatic effort to safe IMF support, lower than per week earlier than this system ends. The South Asian nation wants the mortgage to beat a greenback crunch, ease provide shortages, and elevate the economic system out of a disaster forward of elections this 12 months.

Article content material

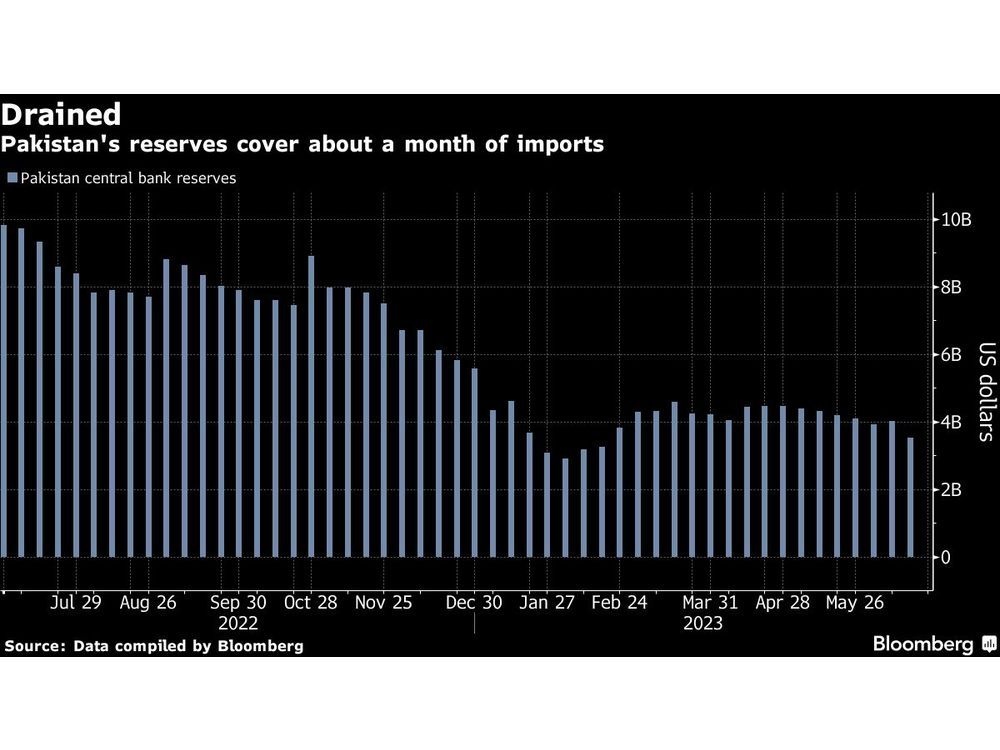

Pakistan faces about $23 billion of exterior debt service for the fiscal 12 months 2024, which begins in July, greater than six instances the nation’s reserves.

Pakistan might default with out an IMF mortgage given its very weak reserves, Moody’s Buyers Service warned this month. Pakistan is the final of three South Asian nations to clinch IMF funding because of delays in delivering reforms and getting collectors to agree amid the political disaster.

Pakistan elevated taxes and vitality costs, and allowed its forex to weaken to fulfill the IMF’s key calls for. The rupee has misplaced greater than 20% this 12 months after officers devalued the forex in January, among the many worst performers on the planet.

Pakistan’s greenback stockpile slid nearly 60% prior to now 12 months to $3.5 billion as of mid-June, limiting the nation’s skill to fund imports together with uncooked supplies, and forcing many factories to droop operations.

Pakistan has had a tumultuous observe file with the IMF with the present mortgage program that began in 2019 stalling a number of instances. The federal government secured employees approval for a $1.1 billion mortgage in August, solely to have it halted because of Islamabad’s failure to fulfill some situations.

Source link